Difference Between Takaful and Conventional Insurance

Based on commercial factors only. Now NRPs and POC holders willing to undertake banking payments and investment activities can do so through digital channels without visiting bank branches in Pakistan.

Takaful Insurance Gulf Insurance Brokers Llc

In takaful participants agree to offer mutual assistance taawun and protection to each other by contributing funds Tabarru into a pool system.

. What is the difference between Conventional Auto Loan and Islamic Auto Finance. Additional 5 for 100 MoF is including insurance. What is the difference between my M2U Account Summary and Bills Statements.

Hence on face value Islamic banks may look similar to conventional banks but the contracts and product structures used by Islamic banks are different from conventional banks. Communication between customer the bank 211 Except for situations where these Terms and Conditions refer to you for giving us notice by telephone you should give us any other formal notice in connection with the Service in writing in hard copy form to any of our branches in Pakistan where you maintain an account or any other address the. Your M2U Account Summary shows your real time account balances and transactions to date.

Comparison of Islamic. A fixed deposit or FD is a type of bank account that promises the investor a fixed rate of interestIn return the investor agrees not to withdraw or access their funds for a fixed period of time. Is a contract between two parties.

An annual must attend business event for Islamic finance professionals from around the world IFN Asia is a confluence of the brightest and most influential personalities of the industry bringing quality and relevant discussions to the stage and invaluable networking opportunities. In a fixed deposit interest is only paid at the very end of the investment period. The fixed deposit with the highest interest we could find was the Affin Bank Term Deposit-i at a rate of 4 while the lowest interest rate was.

Apply for a health insurance on RinggitPlus for exclusive gifts. Any NRP POC holder can now easily open. Auto Finance is a Shariah Compliant contract based product where the bank sells an asset at a profit as Islamic Banks are prohibited from charging interest.

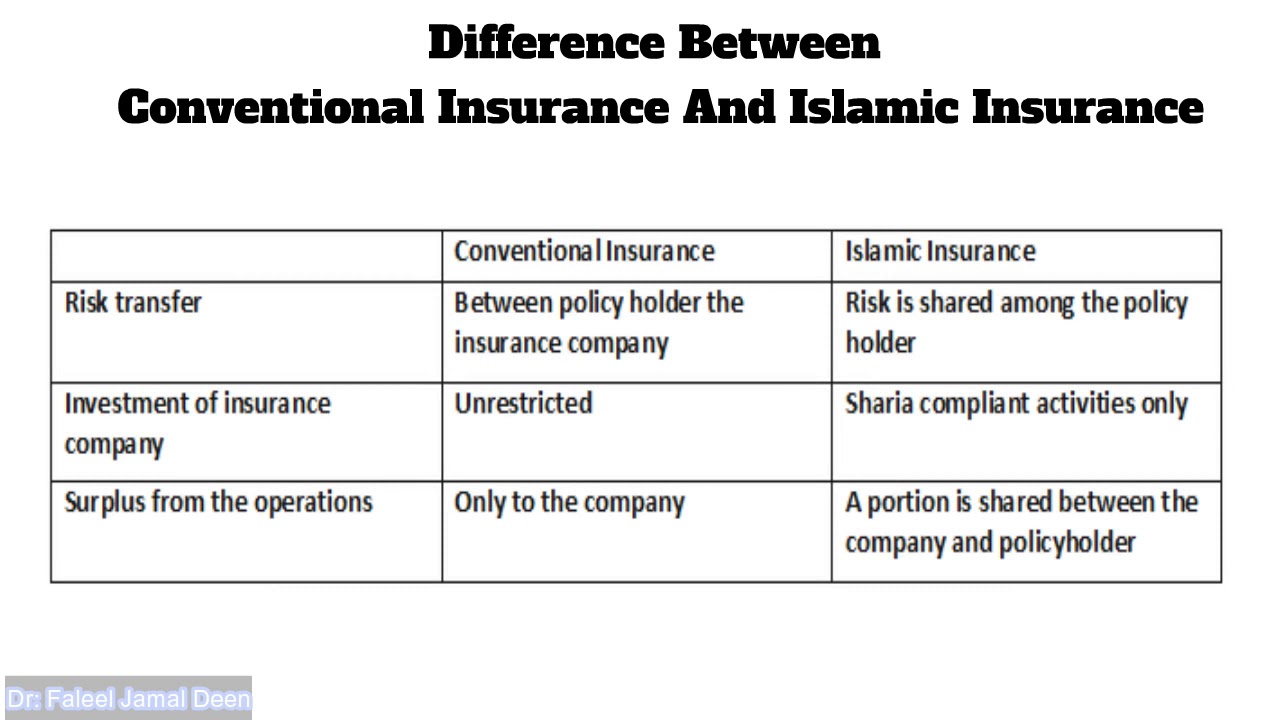

Malaysias takaful assets reached 91 billion US dollars as of December 2019 with the share of takaful net contributions as a proportion of the total insurance and takaful business at 183 percent. Although essentially both Takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below. What is the validity of an LPO.

For Non Malaysian with Resident Gross Income of RM15000 and above. Additional 5 will be added as premium. Based on mutual cooperation.

What is the difference between takaful and insurance. Glossary Islamic Banking Islamic vs Conventional Banking. Joint venture Musharakah.

Furthermore in the verse 2275 of the Holy Quran Allah has responded to the apparent similarity between trade and interest by saying that He has permitted trade and. There is a wide difference between the lowest and highest interest rates offered in Malaysia. MORE ARTICLES The RinggitPlus Blog Sign Up Offers.

Similar to applying for a conventional personal loan the requirements of applicants are the same. Written by iMoney Editorial. Takaful is based on Shariah Laws whereas conventional insurance complies with Government laws only.

MBSB Conventional Fixed Deposit. The IFN Asia Forum is the regions largest Islamic finance gathering. The difference between Takaful and Conventional life insurance.

Avoids interest-based transactions riba and instead introduces the concept of buying something on the borrowers behalf and selling it back to the borrower at profit. Allied Aitebar Khanum Services. Bills Statements stores your monthly account credit card trading account and other statements.

Under takaful people and companies concerned about hazards make. Islamic Financing Conventional Financing. Individual with income documentation only.

Takaful sometimes called Islamic insurance differs from conventional insurance in that it is based on mutuality so that the risk is borne by all the insured rather than by the insurance company. Profit and loss sharing. Yes InsuranceTakaful Accessories and VAT financing is available.

In place of interest a profit rate is defined in the contract. Islamic financing plan with low monthly payments and optional Takaful coverage. Financial Consumer Protection Framework.

Allied Bank Roshan Digital Account is aimed to provide digital banking solutions to millions of Non-Resident Pakistanis NRPs and POC holders. Compare profit rates and apply online now. Further differences are also present in the relationship between the operator under conventional insurance using the term.

One provides the capital and the other provides the labor to form a partnership to share the profits by certain agreed proportions. Student is not eligible to apply except working students with fixed income. Not many scholars made this distinction between these two terms but in the early days Bai Inah was a transaction done by 2-parties and Commodity Murabaha transactions was either a transaction among 3-parties Bank-Customer-Broker or 4-parties Bank-Customer-Broker A-Broker B.

Citis Campaign Offers Up To RM500 Cashback For Travel And Overseas Spend. All eligible ASB investors under ASNB guidelines who are between the ages of 18 and 60 years old. What are the differences between Islamic loan and Conventional loan.

Is a financial contract between two or many parties to establish a commercial enterprise based on capital and labor. Find out all the latest news and exclusive guides about personal finance. This websiteapplication uses cookies to ensure you get the best experience and by clicking I Accept below you consent to the use of cookies.

Before moving further is there a difference between Commodity Murabaha and Tawarruq. The major difference between Islamic personal loans and conventional personal loans is the way banks make their profit. Rather than paying premiums to a company the insured contribute to a pooled fund overseen by a manager and they receive any profits from the fund.

Legal instrument deed cheque is the Arabic name for financial certificates also commonly referred to as sharia compliant bondsSukuk are defined by the AAOIFI Accounting and Auditing Organization for Islamic Financial Institutions as securities of equal denomination representing individual. Insurer and the participants under conventional it is the. For more information about the difference between these loans.

التكافل sometimes translated as solidarity or mutual guarantee is a co-operative system of reimbursement or repayment in case of loss organized as an Islamic or sharia compliant alternative to conventional insurance which contains riba usury and gharar excessive uncertainty. The key difference between Takaful and conventional insurance rests in the way the risk is assessed and handled as well as how the Takaful fund is managed.

Takaful Islamic Insurance Vs Conventional Insurance Youtube

Differences Between Conventional Insurance And Takaful Download Scientific Diagram

Summary Of Differences Between Takaful And Conventional Insuareance Download Table

Difference Between Takaful And Conventional Insurance Pdf Takaful Versus Conventional Insurance Comparing The 2 Types Of Literature Based On Course Hero

No comments for "Difference Between Takaful and Conventional Insurance"

Post a Comment